Content

One non-stick frying pan is much like another, for instance, so you don’t need to tie specific costs to a specific pan. When your goods for sale are distinct, like fine art, antiques or hand-tailored suits, the specific identification method for valuing inventory costs may be effective. If this information is known and accessible, then companies can measure the profitability of each item in their product catalog. Along with that, Specific ID provides the most accurate record of inventory costs and gross profits—which are foundational in calculating your total inventory value. This inventory method is best utilized when a company is unable to identify each individual SKU in its greater product catalog. With that being said, specific identification is not recommended for companies with identical products sold in the thousands.

So in that way, inventory value can have a huge influence on the profitability of your company. Notice that the goods available for sale are “allocated” to ending inventory and cost of goods sold. But, in a company’s accounting records, this flow must be translated into units of money.

7 Inventory Cost Flow Methods- Periodic System

Conversely, the FIFO method likely won’t work as well if your business is just starting out and/or you don’t have much in your inventory quite yet. Once you know what your inventory is worth, you can decide whether you want to stay with your same manufacturers or suppliers, and whether you might need to increase or decrease your warehouse space. In addition, you can better determine pricing structures and how much you’re willing to spend on production . Understanding your company’s inventory value is an important part of running an effective and efficient ecommerce brand.

It requires a detailed physical count, so that the company knows exactly how many of each goods brought on specific dates remained at year-end inventory. When this information is found, the amount of goods is multiplied by their purchase cost at their purchase date, to get a number for the ending inventory cost. In theory, this method is the best method, since it relates the ending inventory goods directly to the How To Calculate Ending Inventory Under Specific Identification specific price they were bought for. However, management can easily manipulate ending inventory cost, since they can choose to report that cheaper goods were sold first, ultimately raising income. As discussed earlier specific identification method helps in calculating the accurate cost of inventory in the company. The company can relieve the cost of inventory items which is sold from the total inventory value.

How to Calculate Ending Inventory Under Specific Identification

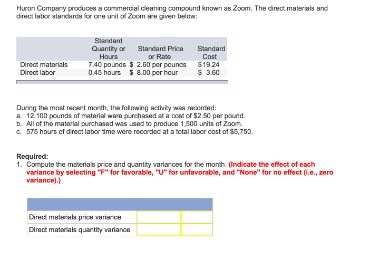

Use the weighted-average cost allocation method, with perpetual inventory updating, to calculate sales revenue, cost of goods sold, and c) gross margin for A75 Company, considering the following transactions. The specific identification costing assumption tracks inventory items individually so that, when they are sold, the exact cost of the item is used to offset the revenue from the sale. The cost of goods sold, inventory, and gross margin shown in were determined from the previously-stated data, particular to specific identification costing. There are a couple of ways you can do them – there is an Inventory Record or a shortcut calculation. Most computer systems will show you the Inventory Record form so you need to understand how to read it. However, it can be time consuming and not practical for homework and test situations so you learn the alternative method as well.

- The company started the current quarter with 100 units of inventory, all of which were purchased at $10 each.

- Since managers are making decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations.

- The assumed flow of costs corresponds with the normal physical flow of goods.

- The costs of shipment and insurance are always included because these are unavoidable costs in the purchase transaction.

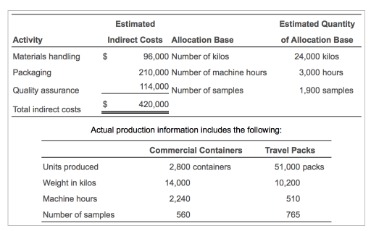

- Here we will demonstrate the mechanics used to calculate the ending inventory values using the four cost allocation methods and the periodic inventory system.

- Calculations become more complex as companies sell a broader range of products.

The method a company uses to determine it cost of inventory directly impacts the financial statements. The three main methods for inventory costing are First-in, First-Out , Last-in, Last-Out and Average cost. Because a company using FIFO assumes the older units are sold first and the newer units are still on hand, the ending inventory consists of the most recent purchases. When using periodic inventory procedure to determine the cost of the ending inventory at the end of the period under FIFO, you would begin by listing the cost of the most recent purchase. If the ending inventory contains more units than acquired in the most recent purchase, it also includes units from the next-to-the-latest purchase at the unit cost incurred, and so on.

Retail Accounting vs. Cost Accounting

Specific identification method is a method of inventory costing that involves identifying and tracking the cost of each item in the stock. The gross profit method is used to estimate ending inventory value in situations where it’s not possible or desirable to measure the actual number of inventory items that the company holds. It can be used to get a rough snapshot of inventory value during the interval between physical inventory counts, or to estimate the inventory remaining after losses due to fire, flood or theft. The main advantage of using specific identification method is that the flow of cost corresponds to the physical flow of inventory. Under this method, the costs of the newest inventory items are used to compute the COGS expense on the income statement. Under this method, the costs of the oldest items in inventory are used to compute the cost of goods sold expense on a company’s income statement.

- If it isn’t unique, you may need to track it with barcodes or RFID chips.

- Beginning merchandise inventory had a balance of $3,150 before adjustment.

- If this information is known and accessible, then companies can measure the profitability of each item in their product catalog.

- Calculating ending inventory is important for businesses in virtually every industry.

- Both methods can be used to calculate the inventory amount for the monthly financial statements, or estimate the amount of missing inventory due to theft, fire or other disaster.

Closely reflects the real cost of replacing current inventory; matches the most recent costs to the most recent revenue. Can result in higher reported profit during times when costs are rising. Beginning inventory is the value of inventory at the start of the period.

The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods. Conceptually, the method matches the cost to the physical https://quick-bookkeeping.net/ flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method. LIFO and weighted average cost flow assumptions may yield different end inventories and COGS in a perpetual inventory system than in a periodic inventory system due to the timing of the calculations.

It is the end of the accounting period, and your boss asks you to help determine the inventory balance to place in the company’s balance sheet. Explain which physical quantities of inventory you will include, and which you will exclude. If you sell different versions of similar items, like the car wash business above, your inventory management software will give you up-to-date data on which items are selling the most. That will enable you to purchase new inventory that meets your current sales trends. The specific identification method of inventory control is useful for businesses with unique or high-priced products. Business uses this method as it helps in keeping track of each item’s precise cost and utilizing it to determine the worth of the inventory; specific identification aids in ensuring the accuracy of business accounting.