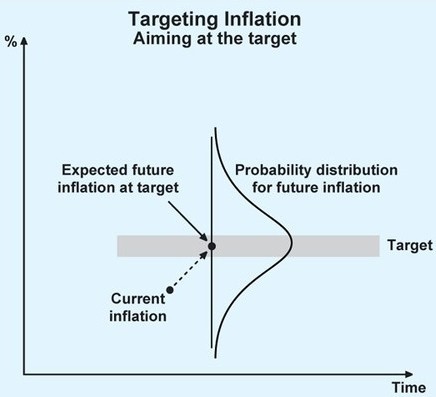

It is generally agreed by banks, and actually agreed between the Bank of England and the UK government, that the inflation rate needs to be at 2%. If the inflation rate rises beyond this, then banks will need to step in to try and reduce it. For example, the inflation rate is at 10.1% in the UK at the time of writing, which means that within one year, all goods and services will be 10.1% more expensive. The Bank of England has increased interest rates, which has been done to cause disinflation, and therefore reduce the inflation rate.

Fast forward to today, when the average cost of a movie ticket is around $10. In 2000, a person with $10 could buy two tickets, but today that same sundry income in final accounts $10 can only buy one ticket. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

The key difference between disinflation and deflation is that the former is always positive but decreasing, while the latter is always negative. Following the implementation of aggressive monetary policies by the Fed to reduce inflation, the increase in prices slowed in the 1980s, rising just 59% for the period. In the 1990s, prices rose 32%, followed by a 27% increase from 2000 to 2009 and a 9% increase from 2010 to 2015. Similarly, a contraction in the business cycle or a recession can also trigger disinflation. For example, businesses may choose not to increase prices to gain greater market share, leading to disinflation. Because interest rates were so high at the onset of the recession, some companies couldn’t afford to drop prices, which may have helped the economy avoid widespread deflation.

This analysis will then form the Consumer Prices Index (CPI), which is then used to find the rate of inflation. Aluminium prices have fallen over 30% from their all-time high hit in March 2022 as weakness in demand from top consumer China continues to hurt prices. Iron ore prices continue to tumble in 2022 on souring demand outlook and rising inventories in Chinese steel mills. For now, the Fed’s ultra-hawkish stance has helped bring down copper prices to 17-month lows.

How Deflation Has Played a Role in History

The Japanese benchmark equity index Nikkei 225 (Japan 225) has not yet recovered its record peak of 38,512 achieved in 1989. Following the Japanese asset price bubble burst and onset of deflationary economic conditions, it is taking the index over 30 years to return to those levels. Shrinkflation and skimpflation are terms for phenomena that can happen as a result of inflation. Words ending in “-flation” are common in economic discussions, and usually prescribe negative conditions in an economy. Generally, each is impacted by supply and demand, and deal with the economy as a whole, not just sectors of it. This phenomenon is actually not a bad thing for the economy, unlike most of its counterparts.

While low prices might sound like a good thing, deflation indicates a struggling economy and can hurt growth. Deflation usually occurs when the money supply shrinks, or there’s a large decrease in spending from the government, corporations, or individuals. All of these situations lessen demand, which in turn drives prices down and creates deflation. During periods of deflation, the best place for people to hold money is generally in cash investments, which don’t earn much, if any, returns. Other types of investments, like stocks, corporate bonds, and real estate investments, are riskier when there’s deflation because businesses can face very difficult times or fail entirely. Deflation is when consumer and asset prices decrease over time, and purchasing power increases.

When demand falls the prices of goods and services will fall until it reaches a level at which people can afford the cost. The reduction in demand for goods and services will further fuel unemployment levels. For understanding the term deflation and disinflation, it is necessary to know the meaning of inflation, which is a situation when the prices of the economic output rise. When the rate of inflation slows down, it is disinflation, and it continues until the rate is zero, but when the rate is less than zero, it is deflation. The basic difference between these two is that deflation is the result of a fall in the overall price level while disinflation is the outcome of a fall in the inflation rate. Many think that deflation and disinflation are synonymous and use them interchangeably as they lead to fall in the general price level, due to which money supply in the economy declines.

In the post-pandemic era, inflation in the US ran to over 40-year highs, which prompted the Fed to embark on an aggressive monetary tightening cycle in a bid to tame rising costs. While inflation is likely to haunt the markets for the rest of 2022, terms like “disinflation” and “deflation” are slowly starting to trend as new market narratives take shape. Here are some examples of the words inflation and deflation used in sentences in the context of economics.

Negative Effects

In general, though, both inflation and deflation go hand in hand with the concept of supply and demand. In economics, deflation is “a fall in the general price level or a contraction of credit and available money.” In simpler terms, deflation means prices are low and money has high value. Cellphone prices have dropped significantly since the 1980s due to technological advances. This has allowed supply to increase at a faster rate than the money supply or demand of cellphones.

High supply means competition, which leads to lower prices as businesses compete over the limited amount of customer demand. Disinflation, meanwhile, signals that prices are falling back to customary levels and that inflation is easing. It’s possible, however, to see disinflation happening when the economy is in or entering a recession. Recessions happen when the economy contracts https://1investing.in/ or shrinks and as a result, unemployment usually goes up while spending and production go down. Governments can also influence inflation by taking steps to reduce the money supply in order to offset the negative effects of a recession. Often a sharp rise in oil prices can lead to stagflation, but falling productivity or poor monetary policy in a nation can contribute as well.

They can also be measured using the gross domestic product (GDP) deflator, which measures the price inflation. Although they may sound the same, deflation should not be confused with disinflation. Deflation occurs when the inflation rate falls below zero, and prices generally decline throughout an economy. Disinflation is what happens when the inflation rate falls but remains positive. In disinflation, prices continue to increase but at a slower rate.

Disinflation vs deflation: what’s the difference?

The housing market is considered the most rate-sensitive sector and economic data is indicating that rising interest rates are cooling housing demand. Investors remain divided over the outcome of the US Federal Reserve’s (Fed) rate hike policy. Many remain optimistic that the Fed can pull off a soft landing as early signs of slowing inflation begin to take shape in the form of falling commodity prices.

Goldman Sachs Research said the housing market has headwinds in supply remaining tight in many geographies including US, Canada, UK and New Zealand. In April, sales of new US single-family homes slumped to a two-year low as home buyers became hesitant on higher mortgage rates. As of 5 July, Brent crude and WTI are trading around $107 and $102, respectively, as attention has shifted from supply concerns to demand weakening due to a possible global recession. Japan, which has been suffering from prolonged deflationary economic conditions since the 1990s, is the most widely quoted deflation example. Can you explain the difference between the cost and price of something?

Difference Between Democracy and Non Democracy

Among these is a “wildly unbalanced economy, with too little consumer demand, kept afloat only by a hypertrophied real estate sector, and its working-age population is declining”. Combined with declining international trade and spiralling government debt, this will have “large implications”, said Evans-Pritchard at The Telegraph. China remains the “workshop of the world”, with the scale to shift the global pricing structure that could have serious consequences if Beijing decides to export its way out of an economic depression. Insights into the political and economic events worldwide that can cause currencies to change and how this can affect your FX business. As of 5 July, the Baltic Exchange Dry index, a shipping and trade index that measures the cost of transporting goods, has fallen about 60% below its 13-year high hit in October 2021.

Again, this may seem like a positive at first—if a cart full of food costs $150 today, what’s wrong with it costing $140 tomorrow? The problem is that as the prices of goods and services decrease, the relative value of cash increases. More investors end up flocking to quality assets that promise a safer investment vehicle. A drop in prices—and, therefore, supply and demand—will hurt the profitability of companies, leading to the erosion of share value. Deflation (and inflation) rates can be calculated using the consumer price index (CPI). This index measures the changes in the price levels of a basket of goods and services.

Unlike deflation, disinflation doesn’t refer to the rise or fall of the price directly, but rather to the slowing rate of price growth. We take a look at the key difference between deflation and disinflation and whether we are observing early signals of deflation vs disinflation in the current macroeconomic environment. The word stagflation refers to a situation in which an economy is experiencing high inflation, high unemployment, and stagnant economic growth. Understanding how disinflation ad deflation differ matters if you’re interested in how consumer price movements may affect your portfolio. Between the two, it’s important to remember that deflation has the potential to be more harmful, though it’s far less common than disinflation. Working with the right financial advisor can give you the confidence to invest for growth during deflation or any other potential difficult investing event.

Deflation vs. Disinflation: What’s the Difference?

The CPI is a theoretical basket of goods, including consumer goods and services, medical care, and transportation costs. The government tracks the price of the goods and services in the basket to get an understanding of the purchasing power of the U.S. dollar. Both deflations vs disinflation are scenarios that may occur in the economy.

- It occurs when the rate of inflation is less than 0% i.e. negative.

- It is generally agreed by banks, and actually agreed between the Bank of England and the UK government, that the inflation rate needs to be at 2%.

- Only time will tell for sure, but economists will continue to argue in the meantime.

- During inflation, the RBI increases the interest rates so as to make borrowing expensive for consumers and the very opposite happens in deflation.

- When statistics are said to be adjusted for inflation, it means that the inflation rate has been taken into account so that things (such as the profits made in different decades) can be compared fairly.

Stocks can, and often do, perform well when the rate of inflation is declining. Bonds are likely to deliver above-average returns in a disinflationary scenario since it makes central banks less likely to raise interest rates and more likely to reduce them. It leads consumers to put off spending money, which creates hardships for businesses, and in many ways leads to further weakness in the economy. When the inflation rate falls below zero, the economy is said to be in a state of deflation.

Deflation, on the other hand, describes actual decreases in prices, not a decrease in the rate that inflation is rising. These periods of rapid price increases are often accompanied by a breakdown in the underlying real economy. However, inflation that begins to rise too quickly degrades the value of cash relative to goods and services, compelling people to spend rather than save. The increased spending fuels more inflation, which can ultimately result in hyperinflation—an extremely adverse condition that’s often accompanied by social upheaval.

Disinflation can often be confused with deflation, but the two are mutually exclusive. The term describes an economy in which the inflation rate remains positive, but is trending downward. If inflation was 10 percent last year but only 5 percent this year, one could say that the economy is experiencing disinflation. Simply put, inflation measures the rate that the price of consumer goods is increasing. If inflation is 10 percent and a month’s worth of shopping costs $1,000, you can expect to spend $1,100 in a month next year. Inflation also thus measures the decline in consumer purchasing power, as it reflects the value of the dollar.

Explaining Inflation, Disinflation and Deflation – Federal Reserve Bank of St. Louis

Explaining Inflation, Disinflation and Deflation.

Posted: Wed, 23 Aug 2023 07:00:00 GMT [source]

Bonds, on the other hand, could be a safe haven for disinflation or deflation. Consumer prices for goods and services can often be a good indicator of what’s happening in an economy. Deflation and disinflation are two terms that some people mix up at times but mean very different things with regard to price trends.

When consumers spend less, companies may begin to produce less if supply exceeds demand. If profits begin to fall, those same companies may begin to reduce their workforce. Unemployment rising can add fuel to the fire, so to speak, and extend an economic downturn.